by Michael Roberts

by Michael RobertsFormer Federal Reserve chief Ben Bernanke, who presided over the global financial crash and the ensuing Great Recession, has a new book out, now that he has returned to academia. The book, with a title that has a certain defensive hubris (The Courage to Act: A Memoir of a Crisis and its Aftermath) focuses mostly on the events of the financial crisis, but it also includes personal anecdotes from before Bernanke’s time at the Fed, dating as far back as his childhood in a small town in South Carolina.

In the book, Bernanke defends the actions of the Fed under his helm in the wake of the financial crisis; in particular the decision to bail out most of the leading investment banks with huge credits and taxpayer cash. He argues that “there was a reasonably good chance that, barring stabilization of the financial system that we could have gone into a 1930s-style depression.” Interestingly, he claims that he would have liked to have saved the investment bank, Lehman Brothers, in September 2008 as well but was forced to allow it to fail because “we were out of bullets at that point.” Out of money?

But what caused this financial collapse in the first place? He now argues that it was greedy and even criminal acts by those who ran the investment banks and mortgage lenders. He told USA Today magazine that more of the bankers and corporate executives who helped cause the financial crisis should be in jail. He says the Department of Justice focused too much, in the wake of the meltdown, on sanctioning financial firms and getting large fines. He said there wasn’t enough effort put into punishing individuals. “It would have been my preference to have more investigation of individual action, since obviously everything what went wrong or was illegal was done by some individual, not by an abstract firm… “What I was talking about is that we do know that…many big banks, the Department of Justice assessed billions and billions of dollars against the firms for bad behavior of various kinds,” he said. “If there are bad actors, you should go after them individually”, he said. However, Bernanke did not speak out at the time because the Fed didn’t have the power to jail anyone. The failure to act on criminality lay with the Justice Department.

But he defends the bailout. “We could’ve gone into a 1930s-style depression,” says the former Fed chairman. This is disingenuous to say the least. What was the Fed doing while those at the investment banking credit boom party were dancing along with ever mounting sub-prime mortgages and derivatives – the financial weapons of mass destruction, as Warren Buffet called them? Nothing.

Although an academic expert on the nature and causes of the Great Depression of the 1930s, Bernanke (like nearly all mainstream economists) failed to see the oncoming financial collapse. In his statement to Congress in May 2007, when the sub-prime mortgage collapse was just getting under way, Bernanke said “at this juncture . . . the impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained. Importantly, we see no serious broader spillover to banks or thrift institutions from the problems in the subprime market”. He went to estimate that the likely losses to the financial sector of the mortgage crisis in the US would be “between $50 billion and $100 billion”. It turned out to be $1.5trn in the US and another $1.5trn globally.

After the crash was over in September 2010, Bernanke, pronounced on the causes of the financial collapse of 2008 and the subsequent Great Recession in testimony to the US Financial Inquiry Commission. He concluded is that it was excessive reliance on short-term funding of key institutions causing instability in the system. This theory, dating from Walter Bagehot in the 19th century, was that banks should not borrow short-term money, but instead get long-term capital. But if banks just relied on customer savings deposits or on long-term bonds and equity investors for their funding, would that have stopped the financial crisis? I don’t think so.

That’s because the cause of financial crisis lay in increasing difficulty for capitalist companies to sustain their profitability in productive investment in the lead-up to the crash. As a result, the financial sector switched more and more to speculative investment in real estate and monetary instruments (of ‘mass destruction’). But to fund the increasing demand to speculate, they had to borrow more money. ‘Leverage’ or debt rose sharply. When the value of all these unproductive assets (mortgages, credit derivatives etc) started to fall, the financial crisis ensued. It was nothing particularly to do with ‘short-term funding’. That only came into play when banks rushed to get more money to service their debts and found that they would not lend to each other. As Marx long ago explained, in a crisis, suddenly a surfeit of money becomes a famine and then there is a desperate rush to hold onto it.

Again back in January 2014, when he finished his term of office, Bernanke signed off with speech at the annual meeting of the American Economics Association. For Bernanke, the global financial collapse “bore a strong family resemblance to a classic financial panic, except that it took place in the complex environment of the 21st century global financial system.” So, for Bernanke, the crisis was purely financial in origin. It had nothing to do with any flaws or contradictions in the capitalist mode of production, but was due to a relaxation on mortgage lending which led to a housing bubble that burst; too much leverage (borrowing) for speculation; and the use of ‘exotic’ financial instruments that did not ‘diversify’ the risks of lending too much, but instead redistributed it globally. This explanation of the widespread and deep nature of the financial panic’ is clearly correct in describing the triggers of the global financial crash. But it does not explain why it happened and why then.

Bernanke, in his academic mode, had established his reputation as the leading economic historian of the Great Depression of the 1930s. In his view, following his hero, Milton Friedman, the Great Depression was the result of wrong policies adopted by the Federal Reserve. First, the Fed in the 1920s allowed excessive lending and kept interest rates too low. Then in the 1930s it applied too tight a monetary policy and raised interest rates. The result was a stock market bubble and then an extended depression in growth and employment.

There is some truth in this analysis. As G Carchedi explains in an unpublished paper, “the monetary authorities often intervene by contracting the quantity of money and/or raising the federal rate. These restrictive policies worsen the financial situation of economically weak firms. They cannot service their debt. Their bankruptcy and, thus the crisis, ensues”.

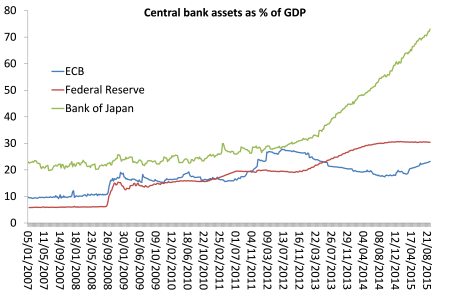

In this crisis, as he says in his AEA address, Bernanke ‘courageously’ applied monetary policies to avoid similar mistakes. The Fed cut its lending rate to near zero, extended huge financial assistance to the banking system, in particular, the largest investment banks that were ‘too big to fail’, and then applied ‘unconventional’ monetary policies, namely expanding the quantity of money (quantitative easing) by buying up government, corporate and mortgage bonds from the banks to stimulate the economy. The Fed’s balance sheet has tripled through QE purchases to 30% of US GDP.

Bernanke is convinced that this policy was a success in saving the capitalist economy. But was it? First, it did not really avoid a financial meltdown. Sure, the likes of Goldman Sachs, Morgan Stanley or JP Morgan did not go bust. But Bears Stearns, AEG and Lehmans did (and Merrill Lynch nearly did). And so did most of the leading mortgage lenders. Moreover, hundreds of smaller banks and lenders across the US went bust.

Second, Bernanke’s great anti-depression monetary policies have not restored world and US economic growth and employment back to pre-crisis levels. In his AEA speech, Bernanke claimed that: “Skeptics have pointed out that the pace of recovery has been disappointingly slow, with inflation-adjusted GDP growth averaging only slightly higher than a 2 percent annual rate over the past few years and inflation below the Committee’s 2 percent longer-term target. However, as I will discuss, the recovery has faced powerful headwinds, suggesting that economic growth might well have been considerably weaker, or even negative, without substantial monetary policy support.”

Maybe this counterfactual defence is right but here we are nearly two years later and the US economy is still growing well below pre-crisis levels and the global economy is showing increasing signs of diving back into a new recession – see the latest IMF estimate.

Indeed, now Bernanke reckons that he is not sure the US economy could handle four quarter-point rate hikes as proposed by some economists and Fed officials. The Fed interest rate may have to stay near zero forever.

Bernanke posed the problem for the strategists of capital at an IMF conference in 2013: “Our continuing challenge is to make financial crises far less likely and, if they happen, far less costly. The task is complicated by the reality that every financial panic has its own unique features that depend on a particular historical context and the details of the institutional setting.” What we need to do is to “strip away the idiosyncratic aspects of individual crises, and hope to reveal the common elements” of these ‘panics’. Then we can “identify and isolate the common factors of crises, thereby allowing us to prevent crises when possible and to respond effectively when not.”

Indeed! But Bernanke’s own challenge does not seem to have been met by him. And yet there were such clues in Bernanke’s own AEA speech. He said: “Like many other financial panics, including the most recent one, the Panic of 1907 took place while the economy was weakening; according to the National Bureau of Economic Research, a recession had begun in May 1907″.

Exactly. And Bernanke could have added that the 2008 recession was preceded by the credit crunch of 2007 and before that by a sharp fall in the mass of profits generated from early 2006 onwards. It was the same story before the panic or crash of 1929 that led to the Great Depression. A fall in profits and output had started a year before. So there was a crisis in production behind the financial ‘trigger’ of ‘excessive’ speculation in copper (1907); stocks (1929); real estate (2008). Speculation was ‘excessive’ and ultimately ‘risky’ because the value generated to deliver gains on such investments did not materialise.

This is a much more coherent explanation of the recurrence of crises; namely the tendency for profitability in capitalist production to decline and eventually leading to an outright fall in profits. Then a credit-fuelled boom turns into a speculative panic or crash.

Bernanke would like us to think that he courageously saved the world by adopting unconventional monetary policies learnt from the lessons of the Great Depression and in the teeth of orthodox opposition. But he did not save the world but only the banks (the biggest ones) and his unconventional monetary policy has not revived the US economy, let alone the world, but only fuelled a new credit-led stock market and bond boom for the 1%. ‘Courage’ in a crisis based on confusion won’t save the world.

No comments:

Post a Comment